what is suta tax rate

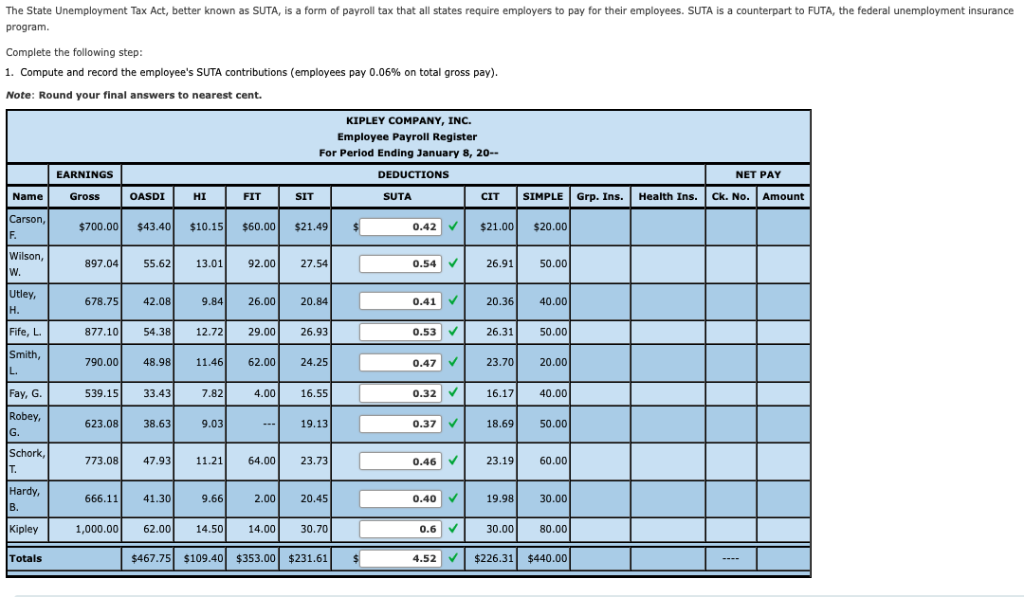

Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year. Each employer is also responsible for a Departmental Administrative Contingency Assessment DACA surcharge of 006 percent.

Are Employers Responsible For Paying Unemployment Taxes

The State Unemployment Tax Act better known as SUTA is a form of payroll tax that all states require employers to pay for their employees.

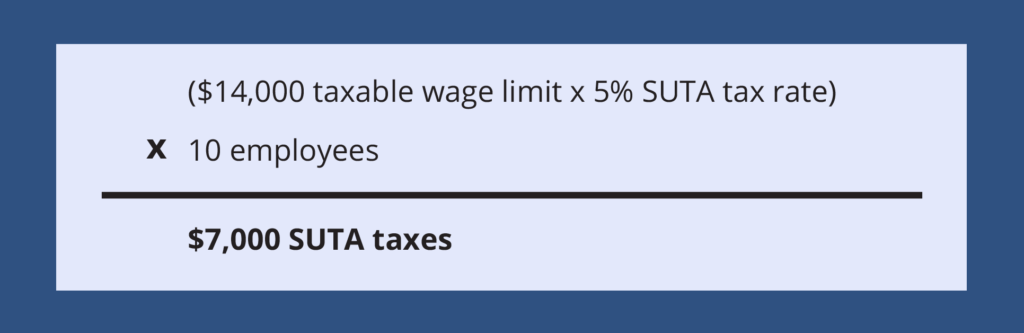

. Employers will receive an assessment or tax rate for which they have to pay. While various states have a variety of state unemployment tax. Please note that tax rates are applicable to the first 14000 each employee earns.

State Unemployment Tax Act SUTA Indiana Code 22 Article 4. In the case of the state unemployment tax this is a deduction made by. Employers who have not paid all contributions.

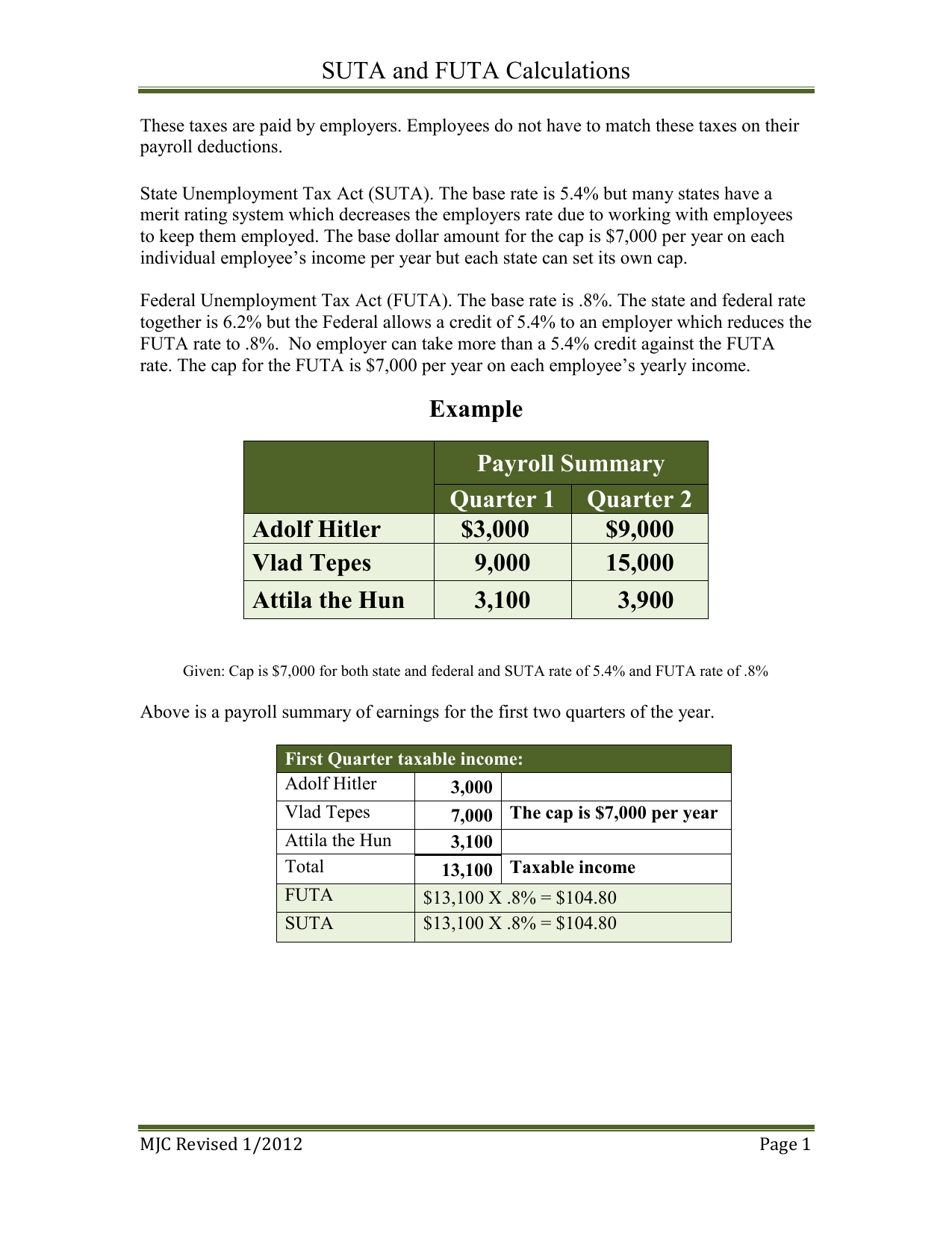

Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee. The reserve ratio is the balance in an employers UI account premiums paid less benefits paid for all years liable divided by their average taxable payroll for the three most recent years. The FUTA tax rate is a flat.

Lets say your business is in New York where. An employers SUTA rate is often referred to as a contribution rate. The FUTA tax rate is a flat 6 but is reduced to just.

What Are Employer Unemployment Insurance Contribution Tax Rates. State Disability Insurance SDI. 52 rows Each state has a range of SUTA tax rates ranging from 065 to 68.

The rate is based on the ratio between the reserve-balance compared to the average annual taxable payroll for the last three completed fiscal years. The SUTA tax rate and taxable wage base the part of employees wages that is taxable are set by each state. This practice known as State Unemployment Tax Act SUTA dumping is a common scheme in which a business with a higher unemployment tax rate shuffles.

California has four state payroll taxes. La Igualdad De Oportunidad Es La Ley Equal. The contribution rate is determined by the employers experience rating.

Some states apply various formulas to. The FUTA tax rate is 6 on the first 7000 of an employees earnings. This contribution rate notice serves to notify employers of their.

20 rows What is SUTA. What are the Current Minimum and Maximum Tax Rates. How is the state unemployment tax calculated.

Tax rates are set each year to fund these components. The wage base limit is the maximum threshold for which the SUTA taxes can be withheld. Like other payroll taxes you pay SUTA taxes on a percentage of each employees earnings up to a certain amount.

Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. State Experience Factor Employers UI Contribution Rates - EA-50 Report for 2017 EA-50 Report for 2018 EA-50. The SUTA tax is a type of payroll tax deducted from paychecks and remitted to the government.

State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Your contribution rate can. SUTA and FUTA tax rates Each.

The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance. This percentage is applied to taxable wages paid to determine the amount of employer contributions due. The 2022 payroll tax schedule is a modest shift down from.

Your SUTA tax rate falls. Equal Opportunity is the Law. Some states have their own SUTA wage base limit.

For 2022 the minimum overall tax rate is 3 and the maximum overall tax rate is 73.

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com

What Is The Futa Tax 2022 Tax Rates And Info Onpay

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

What Is The Federal Unemployment Tax Rate In 2020

Futa Suta Unemployment Tax Rates Procare Support

Systems Understanding Aid 9th Edition Suta And Futa Calculations

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

Futa Tax Overview How It Works How To Calculate

Oed Unemployment Ui Payroll Taxes

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What S The Cost Of Unemployment Insurance To The Employer

Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com